Renters Insurance in and around Gilbertsville

Renters of Gilbertsville, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your belongings are important and so is keeping them safe. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your stereo to your golf clubs. Wondering how much coverage you need? Not to worry! Dave Ladley stands ready to help you consider your liabilities and help select the right policy today.

Renters of Gilbertsville, State Farm can cover you

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

When renting makes the most sense for you, State Farm can help shield what you do own. State Farm agent Dave Ladley can help you create a policy for when the unexpected, like a fire or an accident, affects your personal belongings.

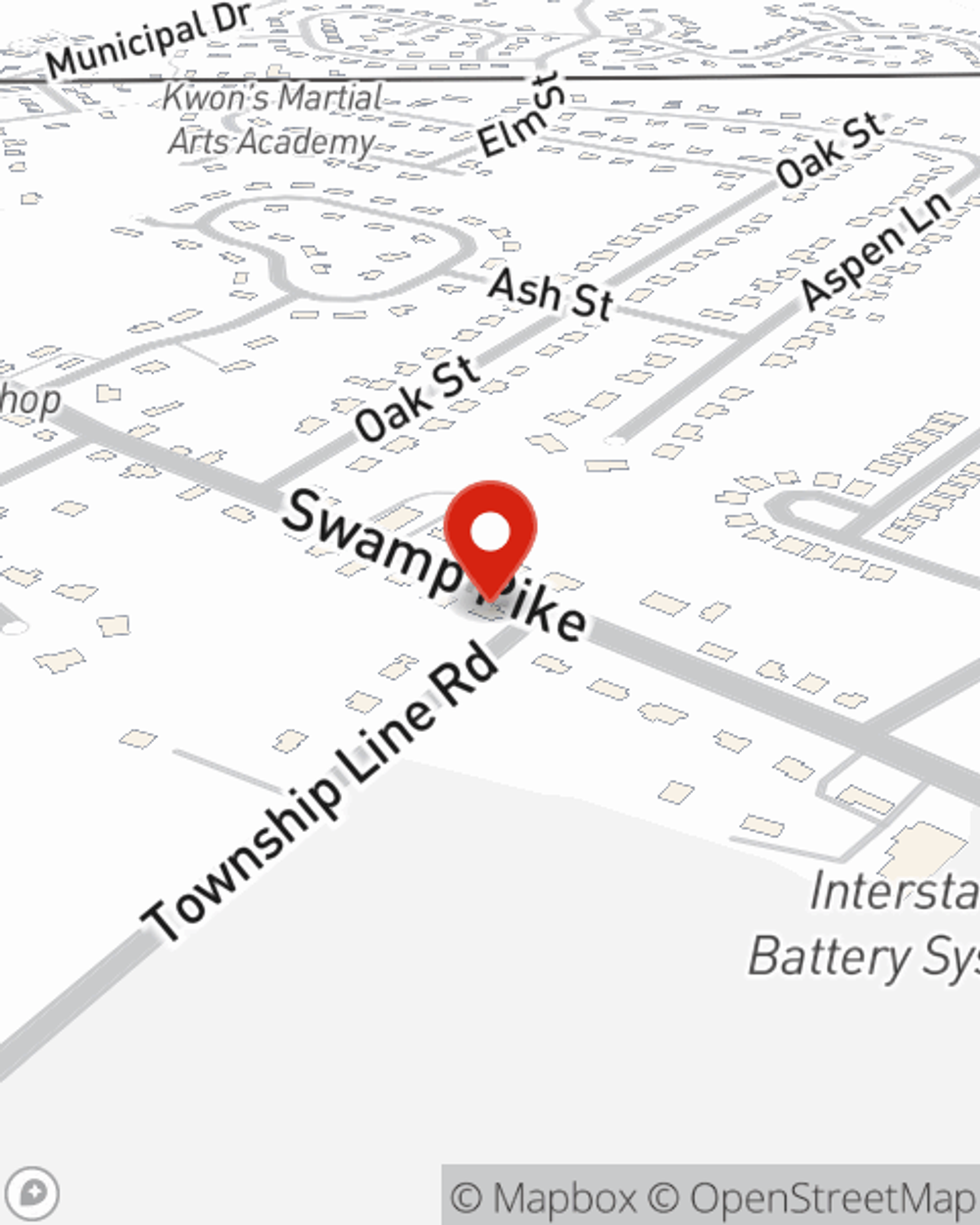

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Gilbertsville. Visit agent Dave Ladley's office to get started on a renters insurance policy that can help protect your belongings.

Have More Questions About Renters Insurance?

Call Dave at (610) 367-4668 or visit our FAQ page.

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Dave Ladley

State Farm® Insurance AgentSimple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.